As payment systems grow faster and more complex, so do the risks associated with them. Traditional fraud prevention tools and manual operations can’t keep up with the speed, volume, or sophistication of modern threats. Gone are the days when artificial intelligence was a luxury in payments; it has become a necessity. At Payarc, our AI-powered platforms are changing how businesses approach security, decision-making, and operational efficiency.

Pie: Making Risk Detection Smarter and Faster

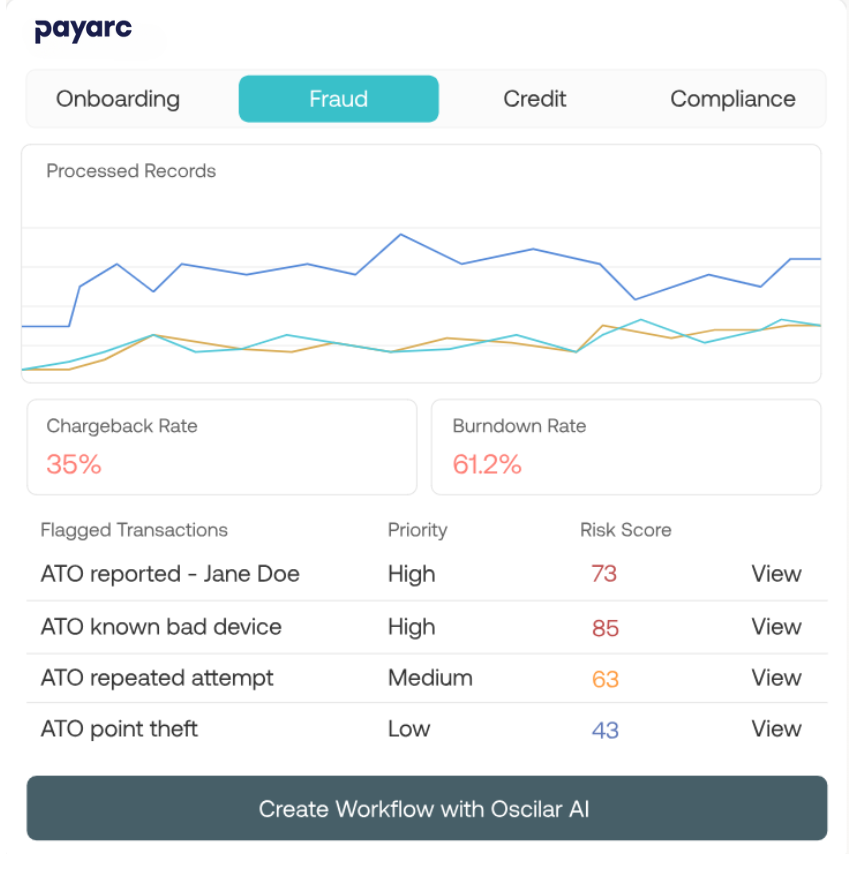

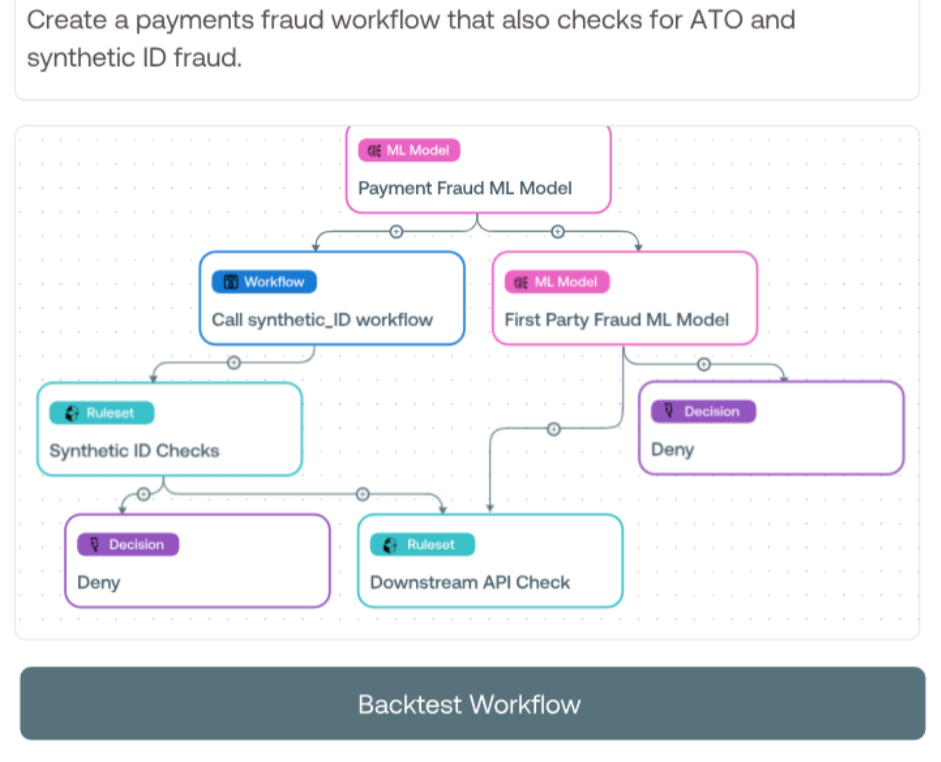

Our artificial intelligence solution, Pie, leverages machine learning models trained on vast transactional data sets to detect abnormal patterns in seconds. Whether flagging unusual purchase activity, spotting high-risk merchants, or identifying signs of identity fraud, Pie operates proactively, intervening before potential loss. Instead of relying on static rules, Pie adapts over time, constantly learning from new data to stay ahead of evolving tactics. It also works with our human risk teams, allowing them to perform reviews 95% faster. Our team members can take swift, informed action by rapidly delivering detailed insights and alerts.

ACH Rejects and Reserve Management Made Easy as Pie

Together, these features allow businesses to maintain liquidity, reduce risk exposure, and scale operations with confidence. By automating and optimizing two of the most critical back-office processes, Pie gives your team the freedom to focus on growth instead of exceptions. AI is redefining what is possible in payments by solving real-world problems that businesses face every day. With Pie, Payarc delivers artificial intelligence that isn’t just smart, but also actionable, measurable, and built to enhance the human side of payments.