As the payment processing industry continues to evolve, the need to find ways to cut costs and improve profits increases. Thin margins like a small percentual fee per transaction can add up for business owners. These are especially hard on small or new businesses. Businesses are now seeking to streamline payment processes and reduce costs, making dual pricing a popular solution.

Dual pricing is popular because it offers a lower-cost option for the customer. This also offers businesses a way to cut down credit card processing costs. On the downside of dual pricing, there is the potential for merchants to abuse the system. They may also need to spend the money to invest in a new POS as some systems don’t have that option to do so. It can also cause confusion and dissatisfaction in customers who don’t want to pay more for using a credit card.

Federal and state laws also apply to dual pricing. Therefore, compliance is necessary for any business using these payment strategies. Failure to comply can result in legal issues and financial penalties. Businesses that follow transparent business practices in regulation with federal and state laws enjoy a handful of benefits. Businesses can enjoy this pricing model by working with payment processing companies, such as Payarc, to ensure they’re offering compliant payment strategies.

Explanation of Dual Pricing

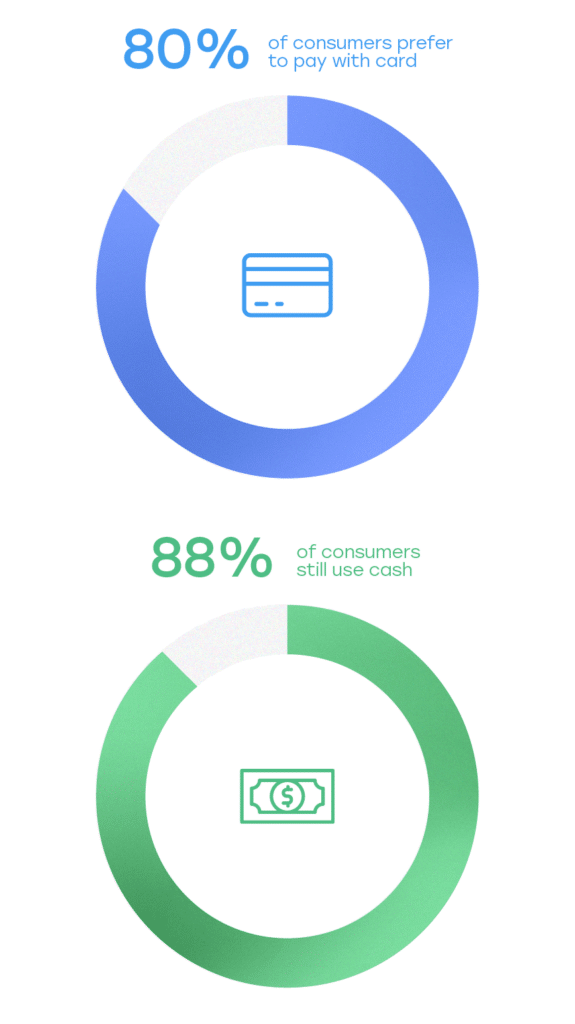

The main purpose of dual pricing is to cover the payment processing fees by passing them onto the customer. This discount typically applies as a percentage of the total purchase price and covers the transaction fees for the merchant. Although 80% of consumers prefer to pay with card over cash, 88% still use cash, making it increasingly important to offer this option.

For example, a restaurant might dual pricing to customers who pay with cash. Meaning, if one of their tables run up a $100 bill and pay with cash, they’ll receive $4 off their total check. Dual pricing has been happening at gas stations for some time now. It is also in different iterations such as online vs brick and mortar.

Since up to 183 million Americans have credit cards, it’s important for businesses to cut down on their transaction fees to save money as much as possible. Implementing a dual pricing program is wise for businesses as credit card companies continue to increase their rates. In 2022, Visa and Mastercard raised their credit card fees even more for merchants. The dual pricing strategy is not only ideal for businesses, but for customers too. As inflation hits a record high, 70% of households are cutting back on unnecessary purchases to cover the high costs of basics.

Understanding and Complying with Dual Pricing Regulations

Businesses that offer dual pricing must understand and comply with the policies related to these pricing strategies. Otherwise, they can be penalized. For example, dual-pricing businesses must abide by the Dodd-Frank Wall Street Reform and Consumer Protection Act. This act requires that any surcharges be disclosed to customers in advance. The surcharge amount must also be reasonable and not exceed the cost of the transaction fee.

Rules and Regulations

Federal Regulations

Dodd-Frank ActThe Dodd-Frank Wall Street Reform and Consumer Protection Act requires businesses that offer surcharges to comply with certain disclosure requirements. Businesses must disclose any surcharge to customers in advance. They also must limit the surcharge to the amount that the business pays in transaction fees. Businesses that offer cash discounts must ensure that the discount is clear to customers and does not discriminate against customers who choose to pay with credit. |

Electronic Funds Transfer ActThe Electronic Funds Transfer Act (EFTA) – a federal law that establishes the rights and liabilities of consumers and financial institutions when there are electronic fund transfers. The EFTA allows businesses to offer discounts to customers who pay with cash, or other non-electronic methods of payment. However, the EFTA also prohibits businesses from charging customers extra fees for using electronic payment methods. |

Truth in Lending ActThe Truth in Lending Act (TILA) is a federal law that requires lenders to disclose the terms and conditions of credit to borrowers. When businesses offer dual pricing, they must ensure that the terms and conditions of the discount are clear to customers in compliance with TILA. |

State Regulations

Specific State Laws

| Some states have specific laws related to dual pricing. For example, in California, a business must provide customers with written notice of any dual pricing program. The notice must include the amount of the discount and the price charged to customers who don’t pay with cash. Additionally, California law prohibits businesses from charging a higher price for goods or services to customers who pay with a credit card compared to those who pay with cash. | In Texas, businesses need to provide customers with written notice of any dual pricing program. It must also prominently display signs indicating that dual pricing is being offered. The notice must specify the amount of the discount and the price charged to customers who aren’t paying with cash. Other states, such as Florida, Indiana, and Oklahoma, have similar requirements for cash discount programs. | It’s important for businesses to be aware of state-specific regulations regarding cash discounts. This is especially important if they operate in multiple states or have an online presence that serves customers across state lines.

|

Licensing Requirements

| Other states require businesses that offer dual pricing to obtain a special license or permit. For example, in California, businesses must register with the state’s Department of Business Oversight if they want to offer dual pricing. The registration process involves completing an application, paying a fee, and providing certain information about the business and its dual pricing program. | Similarly, in Texas, businesses that want to offer a dual pricing program must obtain a permit from the state’s Office of Consumer Credit Commissioner. The permit application requires the business to provide information about its dual pricing program, including the amount of the discount and the price charged to customers who don’t pay with cash. | Other states may have similar licensing or registration requirements for cash discount programs. Therefore, it’s important for businesses to research the requirements in their specific state(s). They must also ensure that they’re properly licensed or registered before offering dual pricing. |

Compliance Requirements

Compliance requirements remain simple to follow and it’s important that businesses do so as card companies (especially Visa) often deploy secret shoppers to make sure merchants are complying with regulations. Merchants found not complying will get penalties and fines. Two important regulations they might be looking at are disclosures and transparency:

DisclosuresBusinesses that offer dual pricing must disclose the terms and conditions to customers in a clear and conspicuous manner. This includes disclosing the percentage, any limitations on the price, and any fees or charges that may apply. Additionally, businesses that offer surcharges must disclose the surcharge amount to customers in advance as well. TransparencyTransparency is a key requirement for businesses when offering dual pricing. Customers must be able to easily understand how dual pricing works and how it’ll affect their total transaction cost. Businesses must also ensure that their pricing practices are transparent and don’t mislead or deceive customers. For example, a business can do this by having a sign in plain sight by the cash register with all the necessary information about their dual pricing. Ensuring disclosures and transparency in cash discount programs isn’t only a regulatory requirement but also a way for businesses to build trust with their customers. By providing clear and honest information, businesses can create a positive reputation and increase customer loyalty. |

Non-discriminationNon-discrimination is an important aspect of compliance when offering dual pricing. Businesses must ensure that they don’t discriminate against customers who choose to pay with credit. This means that the cash discount must be offered to all customers who pay with cash, or other non-electronic methods of payment. For example, if a business has a 3% dual pricing change, the amount must be available to all customers who pay with cash. The pricing difference cannot be used as a way to charge credit card customers an additional fee or to discourage customers from using credit cards. Non-discrimination is required by federal regulations, such as EFTA, which prohibits businesses from charging extra fees for using electronic payment methods. |

Be sure to check out our next blog about the benefits and best practices of compliance